For almost eight years, Manchester

United has been subject to a financial experiment to see whether a highly

leveraged buyout could “work” on a football club. The only other experiment, at

Liverpool, ended in a failure that continues to hurt that club to this day. At

United, the Glazers’ purchase of the football club with borrowed money has been

hugely costly both financially and emotionally, driving a schism between the club

and its core support, sometimes even setting fans against each other.

In the last six to twelve months,

there have been major developments which

mean that the eight year experiment is probably nearing its end. A combination

of unexpectedly high growth in TV deals, new commercial revenues (especially new shirt and

kit deals), the impact of new regulation on the behaviour of

other clubs and the pay down of significant bond debt means we are entering a

new phase in United’s finances where it very possible that debt is virtually eliminated in the next few years.

Although undeniably a good thing,

supporters should not become too excited about the prospects of a debt free

Manchester United. The club has made it clear on its IPO roadshow that it doesn’t

expect to spend more on transfers than it has historically. There is no sign

whatsoever that the ticket price hikes that followed the Glazer takeover will

be reversed. The club continues to refuse (against the advice of government and

Parliament) to engage with supporters’ groups. The listing on the New York

stock exchange means the owners will continue to prize profits over football.

But financially, a big change is underway. This post explains that change.

The story so far: stacking up debt 2005-2010, paying down debt 2010-2012.....

As this blog has described in detail over the last few years, huge debts were loaded onto Manchester United when the Glazers bought the club. By June 2010 these had escalated to over £784m.

The infamous PIK loans were mysteriously repaid in late 2010. At roughly the same time the Glazers started using the cash earned from selling Ronaldo and signing the Aon shirt deal to repay a significant amount of the bonds that had been issued in February 2010. Finally, in August last year, half of the IPO proceeds were used for debt reduction (the other half going to the Glazer family of course). In total, the bond debt has fallen from £509m in June 2010 to £360m at 30th September 2012.

The next chapter..... rapid revenue growth AND

higher profit margins

There can be no doubt that United’s

media and commercial income is going to rise very significantly in the next three

to four years. Unusually in football finance, I believe the club will

capture more of this extra income than usual, in other words profit margins

will rise above their historic level. This will generate significant cash,

allowing debt to be largely eliminated.

Three sources of highly certain revenue growth

There are a number of factors

which mean the club’s revenue growth is highly likely to accelerate in the next

three years:

- Chevrolet. The new shirt deal adds £11.6m pa for

the next two years (on top of what Aon pay) and then a further £11.9m pa (for a

total of £43.5m pa) from the 2014/15 season.

- Premier League rights. We have already seen the

value of domestic live PL rights rise 70% in the next three year cycle. Total

domestic rights (including highlights, online etc) will probably increase

around 60% and we are awaiting the outcome of the international sales

processes. Taken together, a rise of at least 50% in PL TV income is virtually

guaranteed in 2014. Assuming only low growth from the CL and owned rights

(MUTV), that would still drive media revenue up 35%.

- Nike renewal. The long running Nike contract is

beginning to pay out back ended profit share AND is up for renegotiation.

Looking at other kit deals, an increase of £25m on the current £35-38m pa looks

very achievable. Some analysts think the deal will double in value and they

could easily be correct.

These three areas alone will add

almost £110m to revenue by 2015 (35% of the 2011/12 figure). To put that in

context, that’s the equivalent of doubling matchday income.

Other, less certain, sources of growth

Whoever thought of it, the

commercial strategy of targeting diverse product categories and geographies has

been revolutionary. There remains considerable potential to add new

“partnerships” in a number of industry “verticals”. The club have identified 40

industry sectors where it is believed it can sign a global partner, compared to

13 such contracts currently. Add regional partnerships and I see no reason why

such sponsorship income should not double again over the next four years,

adding another 12% to 2011/12 revenue.

The same argument applies to the

new media and mobile segment. Emerging market telecom companies appear to value

the “content” link with United and there are plenty more territories to go for.

My forecast is that revenue will

increase by over £150m (c. 50%) over the next three years (assuming top 4 PL finishes

and CL quarter finals each year), and that of this increase, over £110m (35%

growth) is virtually certain, with and the balance is very likely to occur.

Rising margins

If a huge increase in revenue can

be forecast with some confidence, there remains more uncertainty over costs.

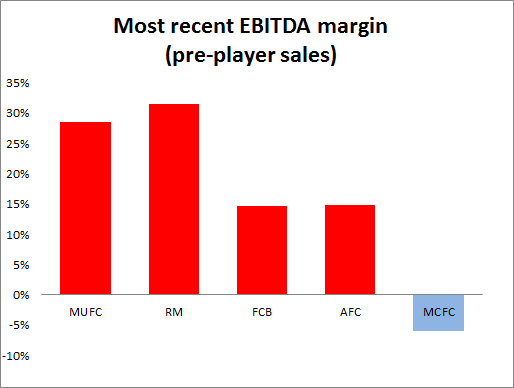

Since the beginning of the PL era, United have reported stable EBITDA* margins

in a tight range, throughout the plc and Glazer eras. In other words, costs have

tended to rise in line with revenues.

[*EBITDA – “earnings before

interest, tax, depreciation and amortisation” – is effectively cash profits

before transfers. It is calculated by deducting cash costs from revenue. In 2011/12

cash costs totalled £228.7m and comprised wages and salaries (£161.7m or 71%)

and other operating costs (£67m or 29%).]

I believe this pattern of stable

margins will change in the future, and that margins will rise sharply above 40%.

For this to occur, United’s wages to income ratio will have to fall. United

will have to hold onto more of its revenue gains than has historically been the

case.

Why margins will rise

The suggestion that a company

that has consistently earned margins within a tight range is about to make a

step change in profitability should always be treated with great scepticism. This

is true even if new revenue sources are supposedly “high margin” (as

sponsorship deals are), as such margin can easily leak away to other

stakeholders – in this case players and agents.

On this occasion, however, I

believe there are new factors that mean United will not have to pass on as much

of every extra pound earned in income to the playing squad as it has in the

past, in other words that margins can rise sharply.

There are two primary reasons behind

this, firstly that much of United’s revenue growth is unusual to the club and

not something competitors can replicate, and secondly that Financial Fair Play

will effectively work to slowdown wage growth, forcing other clubs to “bank”

rather than “spend” their own incremental revenue.

Factor 1: "United only” vs. collective revenues

The first point is very

straightforward, if United can grow its income faster than other clubs, it can

hang on to more of it. There is an important distinction to be made between collective revenue increases (such as bigger TV deals) and “United only” revenue gains (such

as the DHL training kit deal). It is the former that tend to “leak” into player

wages because by definition all clubs (or in the case of the Champions League, all major competitors) receive

the same income boost. The last PL international rights deal gave every clubs c. £7m extra

pa and pretty much without fail they all went and spent it on transfers and

salaries. By contrast, if United sign a unique £7m sponsorship deal, the club

has far more chance of retaining the cash. Much of the club’s expected revenue

growth is going to come from “uncommon” sources; the new Nike deal, the Chevvy

deal, the mobile partnerships etc, etc.

At United, the strength of the

relationship between wages and (mainly collective) media income since 2000 can be seen in

the chart below. The r-squared is 0.69.

By contrast there is not a very

strong relationship between total revenue growth, (which includes

the expansion of Old Trafford, commercial growth, ticket price rises etc) and

wage growth as can be seen below (the r-squared is only 0.26).

Factor 2: FFP and Premier League regulation will change behaviour

Second and more importantly, both FFP and the new Premier League rules are coming and will inevitably change behaviour. The new regulations do not have to

work perfectly to have an impact, rather they just have to alter the way other

clubs operate. The main impact will be that clubs that risk breaching the rules

will “bank” rather than spend additional revenues they earn. Thus the new PL

deal will see a large number of clubs not thinking “let’s use this to boost the

squad”, but rather “let’s hang on to this money to improve our UEFA breakeven

result”. Both City and Chelsea need the £30-40m pa in extra PL revenue to have

a hope of complying with FFP. If they spend the windfall, they will fail the

test. The Premier League rules are specifically designed to dampen down wage inflation by limiting the amount of additional TV money that can be spent on player salaries.

This is a totally new dynamic in English and European football where previously every extra penny earned (and more) was

spent on players. In the longer term, both sets of regulation makes the

next Oligarch/oil sheikh takeover less likely too. If a loss of only €45m is

permitted each year, it becomes impossible to repeat a Chelsea/City/PSG and

initially run up €150m+ losses. In the last fifteen years a new big spending

club has come along every few years. This is likely to end and as in any other

market, the lack of disruptive new competitors should boost margins.

Wages are still going up, just less quickly than revenue

Despite the dampening effects of

regulation, it would be naïve to believe that football wages will stop rising. I would

expect United’s wage bill to continue to grow substantially over the next few

years (in my forecast I have assumed 24% up to 2015, only slightly slower than

the 31% seen in the last three years). The

key thing to note is that this wage growth is far slower than forecast revenue

growth. With income rising c. 50% as described above and costs by only half

this, EBITDA would rise 112%, taking margins from 29% last year to over 40% by

2014/15.

Margins over 40% would generate over £100m of surplus cash per year

EBITDA and margins are just a

means to an end when looking at a company. Cash is king.

For United, many of the main cash

outflows below the EBITDA line are quite certain. Interest this year (post the

IPO debt reduction) will be c. £33m. Tax paid will rise as tax losses are used

up and profits rise, but in a predictable way. The big uncertainty is transfer

spending, and I have assumed £40m net this year and £30m thereafter. Add in

£10m per annum of capex and the huge turnaround in “free” cash flow driven by

the higher EBITDA becomes clear.

On these forecasts, United will

be generating £80-100m of free cash flow in two to three years, and thus there

is the opportunity for substantial debt repayment and/or dividends.

I have

assumed a 50/50 debt pay down and dividend split from 2014 onwards. This leads

to a sharp fall in the club’s net debt position. Net debt would fall from c.

£344m at the end of the last financial year (pro-forma for the IPO) to under £200m in three years. If no

dividends were paid, the figure would be near £100m.

When measured against the size

and profitability of the company, debt at this level is of no material

consequence. The remaining bonds will be easy to refinance well before they are due to be repaid in 2017 at

a significantly lower rate than the current 8.75%.

Even if margins don’t break-out, cash flow will rise sharply

Even if margins don’t expand from

the historic range, United will generate very significant cash flow in the

years to come. If we apply a flat margin of 33% (the average in the last five

years) to consensus revenue forecasts, free cash flow in 2015 is still £67m,

allowing £25-30m of annual dividends to paid and net debt to fall to 1.1x

EBITDA by 2016.

Summary and thoughts

If United continue to qualify for

the Champions League and make it out of the group stages, we can say with a

high degree of confidence that revenue will rise by at least 35% over the next

three years, and is likely to rise by 50% or more.

It is also likely in my view that

EBITDA margins will break out from their historic range and could exceed 40%.

If this occurs, United would

generate £80-100m of surplus cash each year from 2014/15 and be able to pay material

dividends (a yield of almost 2%) AND repay most of the club’s debts. Even if EBITDA margins are only

maintained at the average level of the last five years (c.33%), free cash flow

generation would still be around £50-70m per annum, allowing substantial debt

pay downs.

Many people, including me, have

been highly sceptical of the United business model. It appears however that

through a combination of luck (the TV boom) and judgement (the commercial

strategy), the management have managed to deleverage the balance sheet and keep

the club (reasonably) competitive on the pitch. With the net debt down to under

£300m, FFP coming in and continued strong commercial growth, we are now facing

a radically improving financial position.

None of this make the Glazers good owners for Manchester United. It will take many years before the club makes enough in profits to compensate for the huge costs incurred. If it wasn't for Fergie's miracle work United could have followed Liverpool or even Leeds down the slippery financial slope. However, in light of the rapidly improving finances, the terms of

the debate on ownership will inevitably change. The costs will have been

incurred (I estimate total costs from the Glazer structure will top £1bn by

2016) but they will start to become an unpleasant historical footnote

As the eight year LBO experiment

comes to an end and the financial risk to United ebbs away, the club and its

supporters surely need to re-connect. On issues like away allocations, ticket

prices and engagement with supporters’ groups the club needs climb out of it

bunker. For fans, the financial experiment is thankfully coming to an end, but much remains to be done; on supporter ownership and having a voice in our club and in making sure the cash flows into the football club itself and not the pockets of owners who still show no evidence of caring one jot for supporters.

LUHG