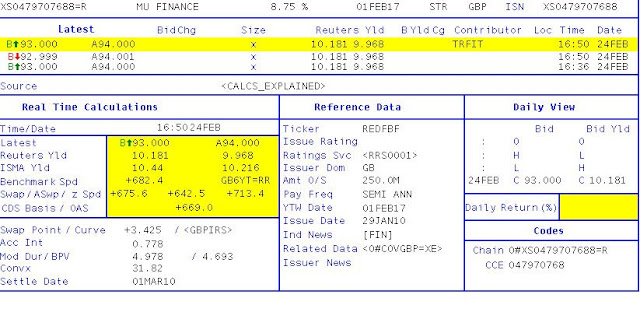

MU Finance's bonds have stopped their collapse in price and appear to have (for the moment) "found a level". For those who don't have access to Bloomberg or Reuters, here are the figures at today's close (all figures are from Reuters).

So still a pretty lousy performance and a yield still above 10% is not a vote of confidence in the business model. One bond manager was quoted as saying the weakness of United's bonds had made it harder for other companies to issue "unrated" bonds.

But the price has levelled out and we shouldn't ignore that. Yielding almost 11% a week ago, that's 7.5% more than gilts (UK government bonds), they did look pretty cheap.

Of course the bonds have to be redeemed at 101% of par in the event that the Glazers sell United. Keep an eye on the price, because if it carries on rising from here, it could be because there are some Red Knights riding over the hill.

LUHG